Making Tax Digital is here

From 1 April 2019, HMRC began phasing in Making Tax Digital (MTD), which requires UK taxpayers to move to a fully digital tax system. Businesses with a taxable turnover above the VAT threshold (currently £85,000) must now keep digital records for VAT purposes and provide their VAT return information to HMRC using MTD functional compatible software.

Are you MTD ready?

David Owen will happily guide you through the process, but essentially 3 steps need to be completed to ensure that you are MTD ready:

1. Use software compatible with Making Tax Digital to submit your VAT returns

2. Sign up to MTD with HMRC at the correct time (see below)

3. Authorise your business’s compatible software for MTD

Let’s take a look at these steps in more detail…

1. Use MTD compatible software

You will need to keep digital records and submit your VAT using compatible software. This can either be MTD compatible bookkeeping software such as Xero, or spreadsheets using special software known as “bridging software”.

If you already have compatible software (see HMRC website for latest compatible software providers), it will deliver the digital information required by HMRC as part of the electronic submission process.

Or, if you would like to continue using spreadsheets, then David Owen has the bridging software that will convert the spreadsheets into an MTD compatible submission.

2. Sign up to MTD with HMRC at the correct time

Each business needs to sign up individually to MTD; HMRC will not automatically transfer businesses to MTD.

The sign-up process can be initiated either by the business or by David Owen as the agent. Businesses can sign themselves up on “Sign up for Making Tax Digital for VAT” using their existing government gateway user credentials and the VAT number of the business.

The timing of this step is critical – it is the point of no return.

A business should not sign up to MTD until all of its non-MTD VAT returns have been filed. Once a business has been signed up to MTD, it will not be possible to file any VAT returns through the government gateway online VAT return or using non-MTD compatible VAT filing software.

Allow at least 24 hours after submitting the last non-MTD VAT return before signing up (more if payment is made by direct debit – see below). HMRC will send an immediate acknowledgement and will follow this up with an email (usually within 24 hours, but it can take up to 72 hours) confirming that the business can now use their MTD software to file a VAT return.

Do not attempt to file the first MTD VAT return until the confirmation email has been received.

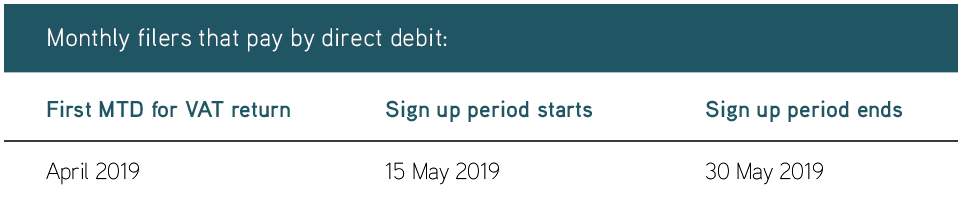

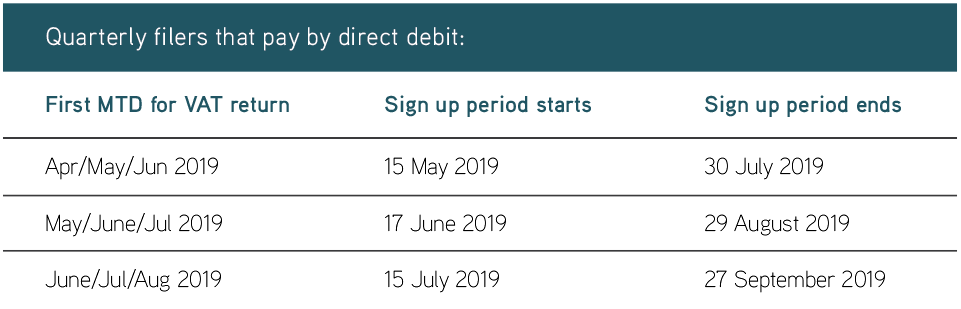

Those that pay by direct debit have a more restricted time period in which they can sign up, due to the impact of banking regulations. Where payment is made by direct debit, the business cannot sign up in the 5 working days after the submission deadline for the last non-MTD VAT return, and, must sign up at least 7 working days before the first MTD VAT return is filed.

This can be illustrated as follows:

3. Authorise your MTD software

Before a VAT return can be filed from MTD compatible software, the software must be authorised to communicate with HMRC systems. This process is initiated by the software product and will look slightly different in each product.

The process involves:

- Checking that the product has been upgraded by the software supplier to be MTD compatible

- Entering the business’s government gateway user credentials into the software

- Providing additional details including setting up 2SV (two-step verification)

The software will require re-authorisation periodically – at least every 18 months, sometimes more frequently.

If you’ve managed to complete all of these steps, then you are MTD ready – congratulations!